They may not be as sexy as POS devices and customer-facing apps, but payment services can unlock many benefits for merchants.

Here, Castles Technology highlights what makes them so special.

Keeping your POS estate secure and ready for business is fundamental. But with constant innovation, updates and changes, managing the process can be challenging – not to mention costly and time consuming.

The support you need depends on the scale and location of your POS estate and availability of technical staff. You may not have the resource or skills to do the job effectively in-house.

That’s where having a POS provider that can offer end-to-end payment services comes in. Outsourcing your payment services is a great way to ensure POS performance, increase ROI and maintain uptime. Here’s how:

6 ways payment services keep you optimized for success.

1. Make better decisions from the get-go

With so many options it can be hard to select the right devices, specifications and volumes to suit your operations – and ambitions. Payment services gives you access to experts right from the start to keep your procurement process on track.

2. Remove installation headaches

Even the best POS devices may fail to perform if the installation is poor. Payment services makes sure things go smoothly. It manages everything from connection to mobile integration and system set-up, ensuring that you can quickly start taking payments following delivery.

3. Stay safe with constant updates

Once up and running, it’s important to keep your devices up to date with the latest software releases. Payment services can coordinate update sequences and ensure easier compliance by managing secure key loading for P2PE encryption.

4. Get the right support at the right time

For many retailers having their own 24/7 support is almost impossible. With Payment services you can access helpdesks, log incidents and have a process for dealing with issues and outages fast. Scheduled servicing, and next-day swaps keep disruption to a minimum and ensures secure handling of terminals through their life cycles.

5. See clearer and in real-time

With a dedicated payment service you can access a single dashboard that lets you see what’s going on across your entire terminal estate at any given time. As well as detailed reporting for business insight, compliance and auditing, and lets you schedule updates and maintenance more effectively.

6. It shrinks your cost of ownership too!

Your hardware and software are likely to represent around a quarter of the total cost of ownership (TCO) of your POS estate.

Other lifecycle costs including installation, support, upgrades and service management make up over half (51%).

Payment services when delivered as part of your contract with your terminal supplier can help you to reduce these costs and make budgeting easier. And it frees up your own tech staff to focus on other priorities.

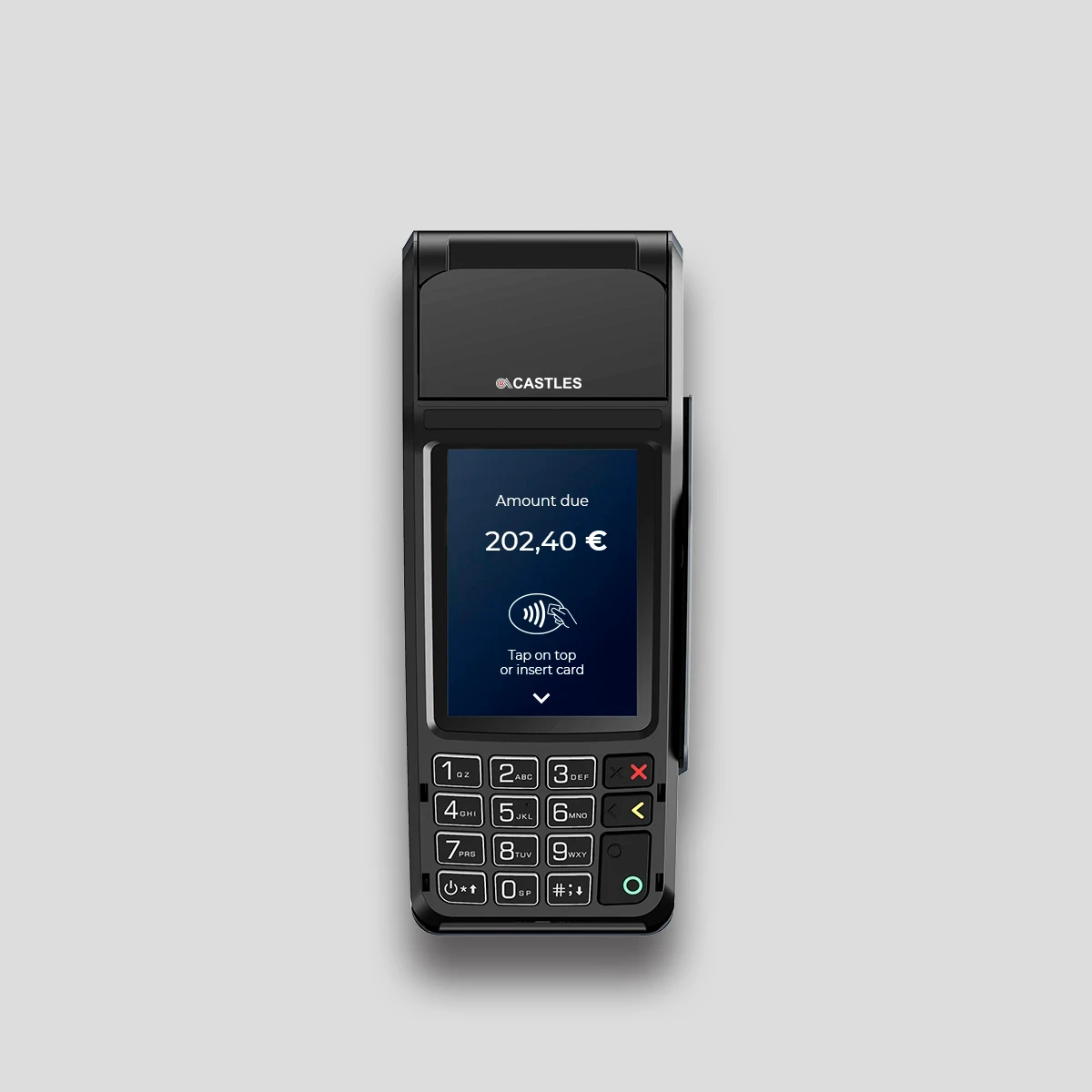

At Castles we offer a full range of Payment Services to support our world-class terminal range.